SPY began the week off last week’s lows with a staggered move down to Monday’s LOD. This held the last intraday swing low from last Thurs and SPY would print a rally the rest of the week with two full gap ups. The week would end with SPY printing a new 52-week high early but fading the rest of the day.

My idea coming into this week was largely bearish or neutral as I wanted to see SPY dip down to the lower $430’s. That did not stop me from taking long positions, some exposed and some protected. I was confident enough to buy 7/14 SPY $430 puts but not confident enough to load up. With that, it was a down week for me with some saving graces from GOOG 0.00%↑ and MAT 0.00%↑.

GOOG

I’ll have a detailed trade analysis on this published later today as I think there’s some good information here to be learned. I got sucked in on a false breakout above descending trendline resistance (DTLR) but not confident enough to leave it unprotected.

I opened a 7/14-7/21 bull calendar spread at the $126 strike on Jul 5. Unfortunately, the market gapped down the next day and took GOOG with it eventually making a lower daily low. That low would hold descending trendline support (DTLS) but by this time I decided to close the position for a loss of 75%. In hindsight, I should have kept it open but as I’ll discuss in my later post, I try to ignore hindsight as much as possible.

On Jul 12 GOOG made another run to DTLR but couldn’t get a move over. Still, it had triggered an alert early in the morning and I liked how it held the open while the rest of the market was rather weak.

On Jul 13 we got a full gap up on heavy volume and I took an early position, adding on near the end of the day as GOOG digested gains. The 7/14 $123 calls were closed Friday morning for +126% per contract, nearly 2x the losses from the calendar spread.

Had my market idea for the week been bullish, I may have held the long side of the original calendar spread as by that point we were testing that DTLS. But you can see in the chart below SPY (orange) and XLC (blue) were moving up while GOOG was moving down. No sense waiting to see what happens.

FIS

FIS 0.00%↑ is a good example of opportunity cost, in addition to hanging onto false breakouts. FIS had been in a tight range for quite some time but on Jul 3 printed a doji after a full gap up (FGU) right into resistance. The next day saw continuation and FIS held the gains while the market pulled back, thus me taking the position.

Unfortunately, it would not get follow-through and FIS began building a new range holding the Jul 3 FGU but also holding below that Jul 5 SH. On Jul 12 both the market and FIS opened with a FGU. But, while the market held the open and digested the gains, FIS immediately filled the gap. That’s a sure damn sign there are no buyers yet. I was a bit more patient closing it than I should have been but loss-wise, it would’ve been the same.

The position was 7/21 $60 naked calls closed for -60% per contract.

MAT

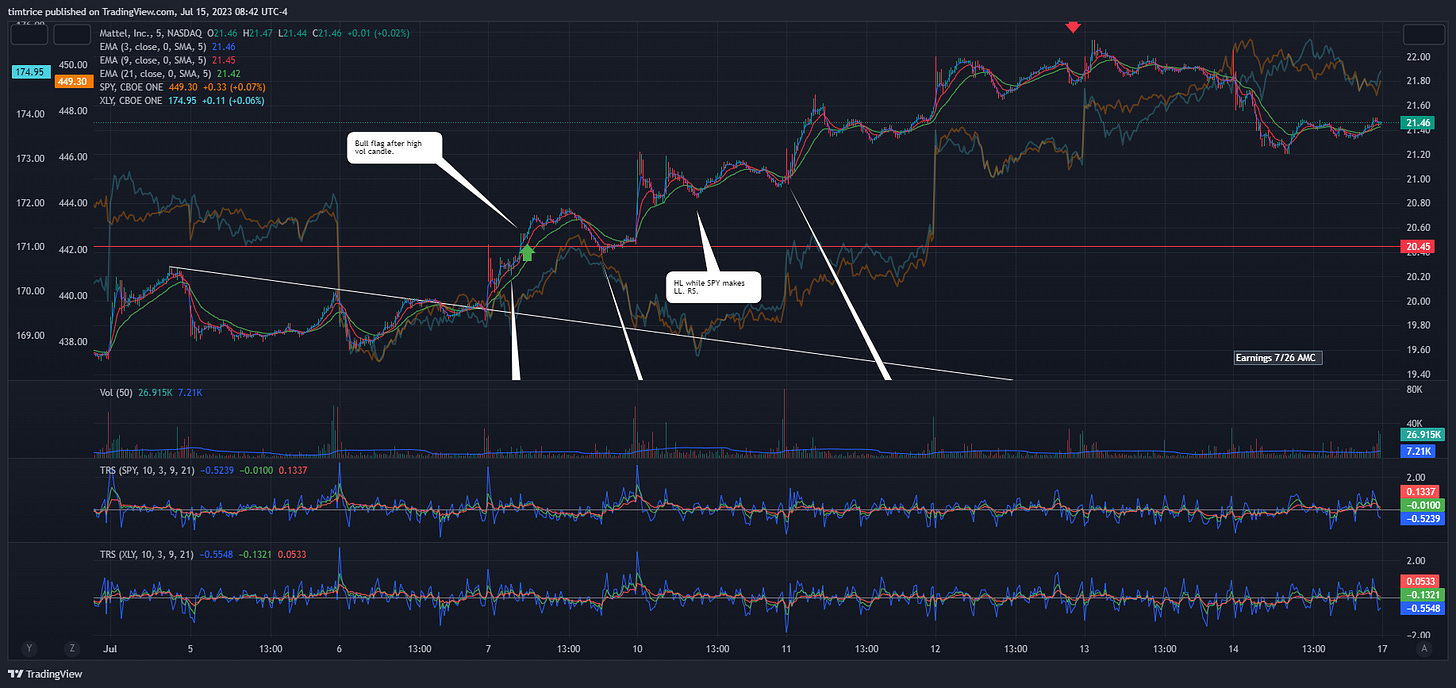

MAT 0.00%↑ was flagging when I found it after-market Jul 6. The next morning MAT would gap up and reverse before retesting the HOD. Soon after the retest, MAT would break through on a large green candle where it’d consolidate again, holding tight the top 25% of the 10:55 candle. On follow-through (FT) I opened naked calls for 7/21 at the $21 strike.

This was a very nice, easy trade that required little thought from me. Each day saw a gap up and though the days would print as doji’s, there was never a reason to close the trade.

That time would come on Jul 12 where we’d gap up deep into resistance from the Feb 3 ‘23 SH. I initially considered closing the position on the 11th but that daily candle was the best of the past three days and on above average volume albeit less than the previous day.

Total gains on this one was +171% per contract.