SPY Prints Best Week Since Early Sep

Buyers will want to continue building off $365. A close over $380 will be a strong indication of a move back to the $425 area.

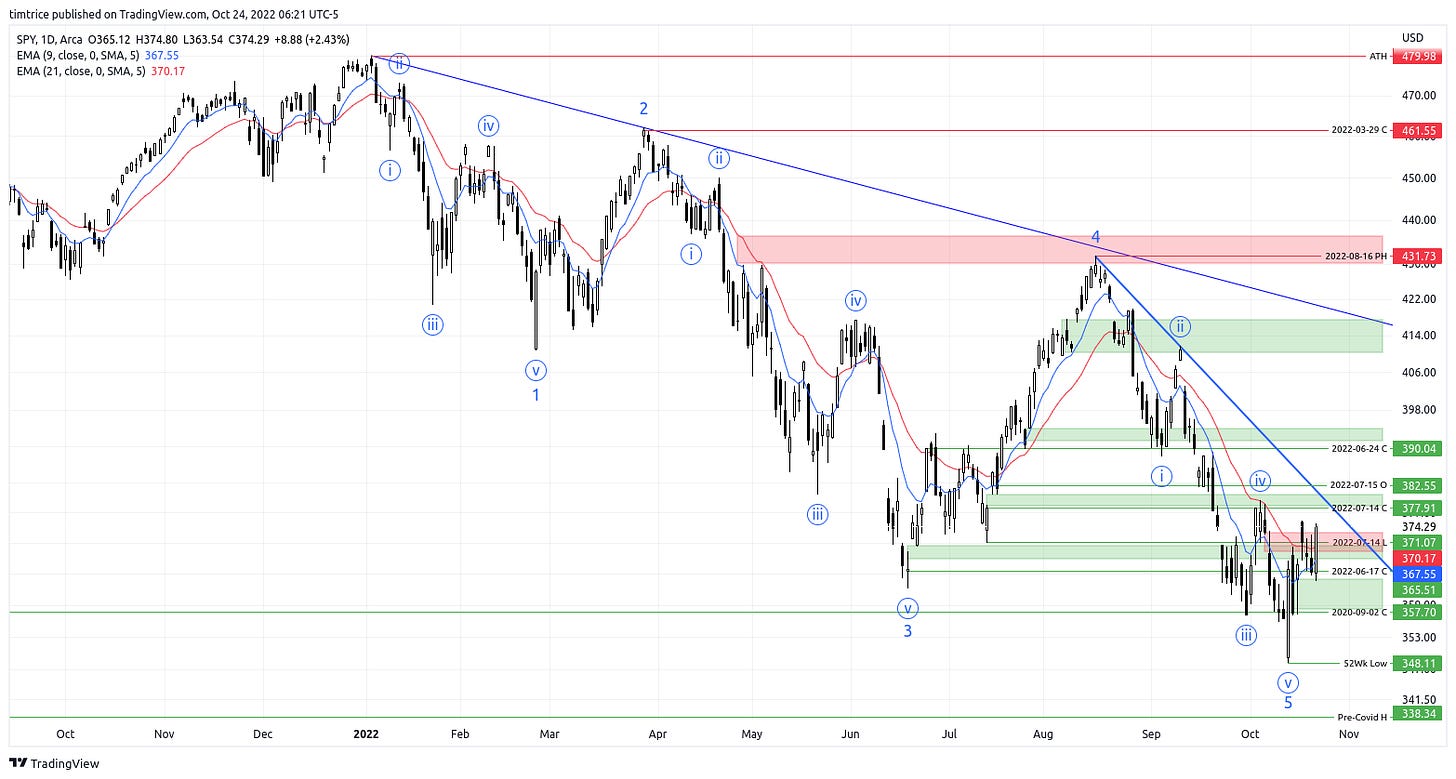

SPY ended last week with a nice daily rally to close near the weekly high. Friday was such that it took out nearly three days of losses. However, we remain under resistance and while I remain somewhat bullish there is a high likelihood we remain in a correction and another leg down is possible.

The next significant level of resistance is around $378 which is the bottom of a gap from Jul 14. We saw this level act as some support on Sep 16, 19 and 20 before breaking on Sep 21. We got the backtest on Oct 4, 5, and 6 which held confirming resistance. So this level does carry some significant weight in my opinion.

I wrote the last time that I felt $358 was a key support level. I still feel this way. But with the recent price action I think we can add the June 17 close around $366 as well. This level did serve as broad support during the downtrend as we went into a sideways consolidation - better visible on the 5m chart. But on the daily we can see prices closed near here on Oct 13 and rejected the following day. After the full gap up reversal on Oct 18 that level did hold as support on Oct 19, 20 and 21. Buyers will want to see SPY get some separation north of this level this coming week.

Sector Analysis

Energy remains the strongest sector at the moment. I wrote last week I wanted to see $83.50 break in order for XLE to continue showing relative strength. We got that on Wednesday. Thursday and Friday both printed follow throughs with a partial gap up reversal followed by a partial gap up continuation Friday. XLE is now into an open gap from Jun 13 so expect some resistance around $89.

I had also written that financials and communications were showing some strength but needed to clear key levels; specifically XLF over $32. XLF did peek over $32 on Tuesday but that was immediately rejected. Friday XLF closed at $32.19 so we’ll need to see some continuation starting today.

Communications, on the other hand has turned relatively weak and as long as it stays under $51 I’m not interested in any longs here.

Real estate remains very weak. If SPY cannot sustain a move over Friday’s close I’ll be looking at real estate first for short positions.