We remain in a correction that has seen no resolution or hints of a resolution in either direction. This means we are in a low probability trading market where you can day trade from either side with some confidence. Swings, however, should be prepared to see their positions in red.

My bias is to the upside. As I posted Friday morning, however, I am open to SPY dropping to the low $430’s. Friday’s action gave me no reason to change that opinion.

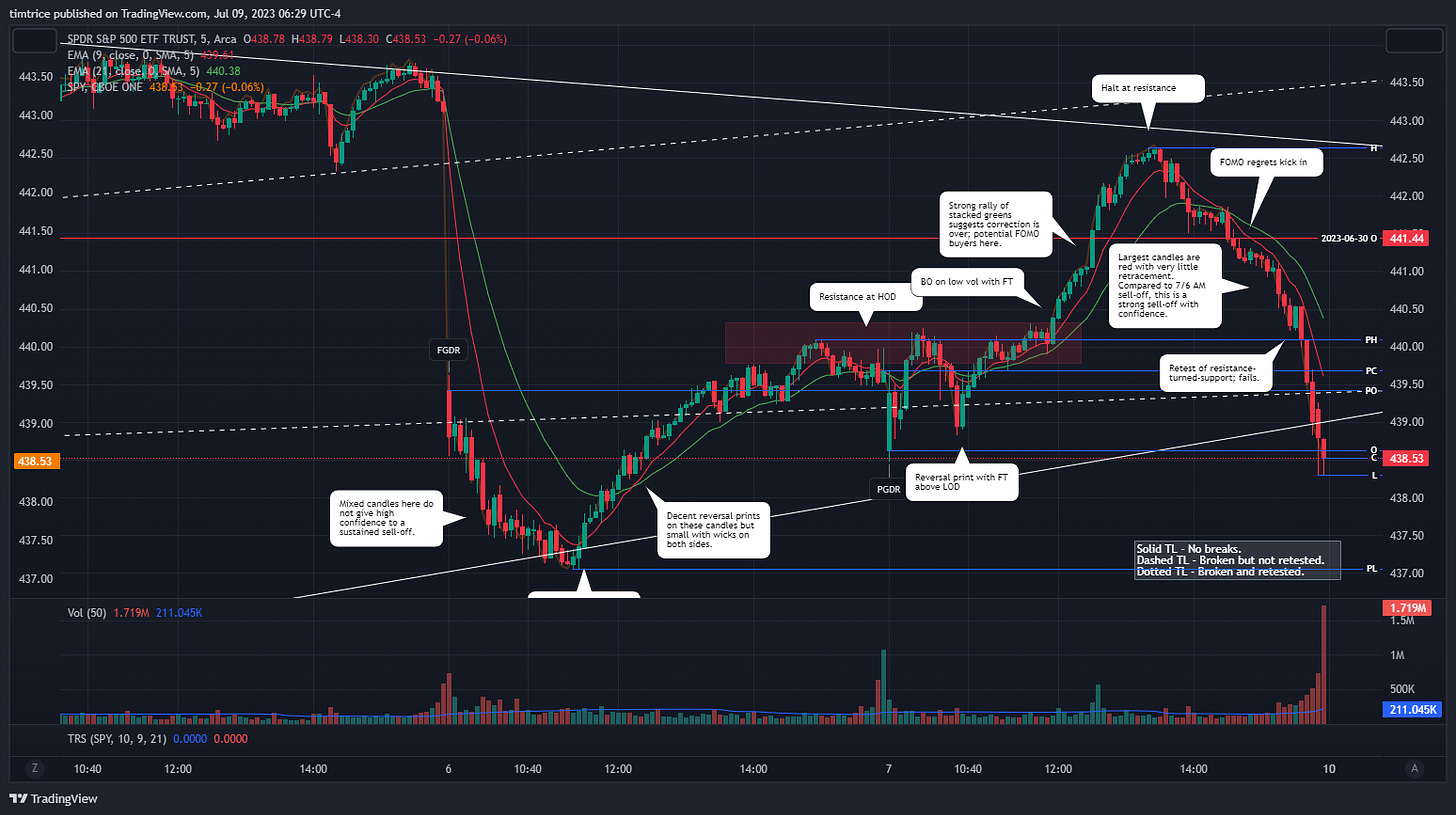

We started the morning with a partial gap down reversal that saw the opening five-minute bar fill the gap. There was some continuation into Thursday’s resistance before SPY attempted a retest of the opening candle. That retest fell well short and buyers came in pushing SPY into the 7/6 gap, nearly closing it before finding TL resistance from this week’s swing highs.

From there, however, buyers capitulated and SPY would print a new LOD on the final bars with a C that barely printed a green daily candle but below Thursday’s open. So much for progress.

The $430 area remains major support with multiple technical points;

7/26 SL

Quaternary TL from 3/13

Ghost TL resistance from 3/6/23-4/18/23 SHs

I want to note when I draw my trendlines I’m willing to allow a close above or below if that close is rejected the next day. My quaternary TL does this for May 24 where the next day SPY opened with a full gap up back above the TL. I consider May 24 an outlier.

There also potentially remains a ghost TL resistance off the 12/1/22-2/2/23 SHs. I find this TL interesting because it largely held on tests from June 13 and 14 before giving on the 15th. The 16th saw a reversal but stayed above the TL suggesting that was now broken. But the next bar - Monday, Jun 19 - gapped down below the TL and we stayed below until another FGU on Jun 30. There we had three green bars with zero follow-through before gapping back down to the level of that ghost TL. Is it a coincidence? Sure could be. But I can’t ignore it. For the time being I have it broken but not confidently retested. Certainly this is subjective and other TAs may disagree.

These are the scenarios I’m looking to play out going into this week:

A relatively large green candle with higher than normal bottom with either a bottom off

$438-$440

$430

A relatively large red candle that punches through $430.

My bias is towards #1 and, in particular, #1b. Until I see this I’m trading long positions (partial-sized) with interest in swinging shorts as hedges.

I have SPY $430 puts for 7/14 as a hedge to my current long positions (FIS, JPM, SQM, MAT, GOOG, RIVN, RIOT).