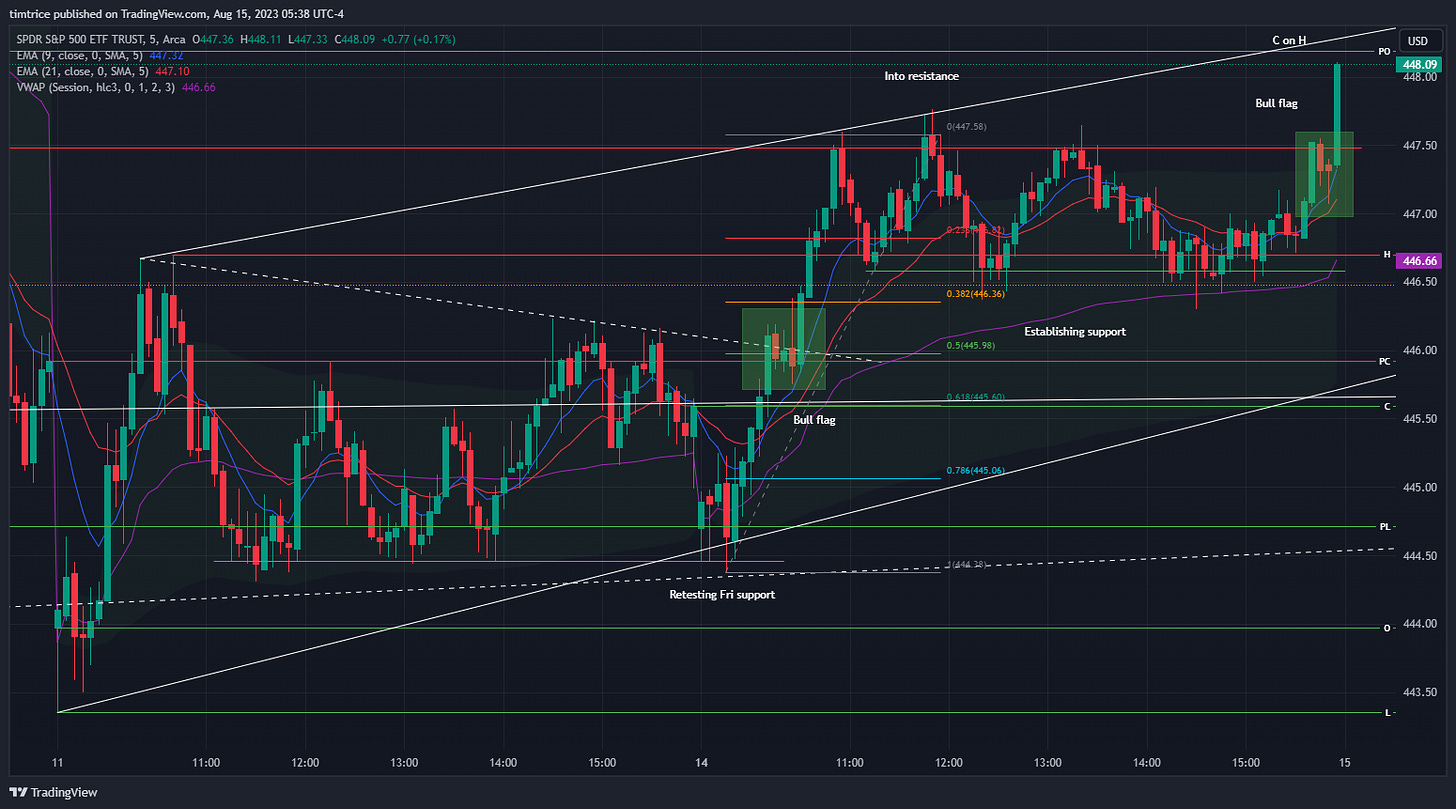

SPY has been trying to work itself from the Friday opening low at $443.37. The action Fri was quite sloppy but Monday did present better opportunities on the long side. It’s the type of action buyers would want to see to gain confidence the lows are in.

We opened yesterday morning retesting $444.50 support from Friday. Very soon SPY began printing green candles; the very first push off had long wicks on both sides but immediately we started getting closes near the H.

Once we ran into DTLR from Fri SPY paused a bit printing a bull flag. The initial BO was rejected but buyers immediately reclaimed the BO and SPY would double the day’s gains in the same period of time (5 and 6 bars, respectively). By this point we were well extended from the EMA+ and VWAP so a correction was obvious. SPY would retrace the morning move and spend the rest of the day meandering before running to a new H by EOD.

That support we established in the afternoon yesterday was off the Fri H. So buyers are doing some good work here.

On the flip side, selling pressure remains heavy as /ES futures overnight have taken us back under the Fri resistance. As of this writing SPY remains above that $446 line. In the chart above you’ll note ascending support currently around $445.75. Any test of this line is a well-defined opportunity for new long positions with clear minimal risk. A move below and obviously it’ll greatly increase the likelihood of us taking out that Fri low.